Olympus @ CP+: A first chance to talk strategy with new Imaging Business Unit head, Shigemi Sugimoto

posted Friday, April 27, 2018 at 1:17 PM EDT

At CP+ 2018, we had the opportunity to sit down with Mr. Shigemi Sugimoto, Head of Olympus Corp.'s Imaging Business Unit. He was appointed to this position October 2017, so this was our first opportunity to discuss Olympus business position and general direction for their imaging division with him. It was encouraging to hear that the news is generally good, despite the industry's general downtrend.

Given Mr. Sugimoto's position at the head of the Imaging division, we took advantage of our time with him to explore broader topics rather than focusing on specific technical details of products. I had the opportunity to ask questions of that nature the week following CP+, when I visited Olympus' R&D headquarters in Hachioji, Japan. We'll share the contents of that discussion in a later article.

Before we began with our interview questions, Sugimoto-san said he wanted to give us an update on Olympus' financial position, and we of course agreed. (And after hearing what he had to report, we could understand his eagerness to share the good news. :-)

Here's Sugimoto-san:

Shigemi Sugimoto/Olympus: There are three business categories. Medical, scientific solution and imaging. Olympus' main business is medical now.

Dave Etchells/Imaging Resource: Yes, right; the endoscopes. [Ed. Note: Olympus is by far the dominant manufacturer of medical endocopes worldwide; it's been a mainstay of their overall business for many years.]

SS: Imaging contributes to enhanced joy and excitement of life. Our imaging technology is used in medical business also, though, so we are a driver for our company as a whole. <gestures to a pie chart on a handout he gave us.> On the right side is financials for the third quarter of fiscal 2018. Net sales is 47 billion yen, almost the same as the last period. But our operating income is 1.5 billion yen. Improved some 77% compared to last year. [Ed. Note: Like most Japanese companies, Olympus operates on an April 1 - March 31 fiscal year. The fiscal years are identified by the calendar year they end in, so fiscal year 2018 refers to the period from April 1, 2017 - March 31, 2018.]

DE: Wow, a big improvement!

SS: Yes, thank you very much. On the left and bottom is the total Olympus financial situation. Our sales and profitability has been solid over the years because medical is very profitable business, so our projected sales for fiscal year 2018 is 784 billion yen, with operating income of 86 billion yen.

DE: Yes.

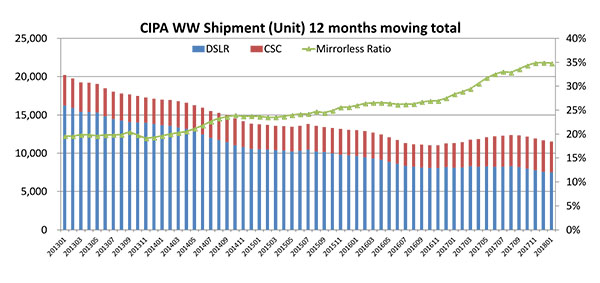

SS: And on right side, the graph shows the ratio of mirrorless. As you see, gradually, the mirrorless ratio is growing. Because as the market declines, mirrorless is still keeping its volume. So now, the mirrorless ratio is 35%. This is our market situation. This is the shipment data from CIPA.

DE: Ah, yes. This isn't one of our questions but as you said, there's a been continued decline in the overall market. Do you think it will at some point level off, that we will get to a replacement stage where it will become stable, or will it continue to decline?

SS: The chairman of CIPA mentioned in his speech this morning that shipments are taking an upturn.

DE: Ah, so shipments are going up, unit volume; that's very good news, compared to the recent past.

SS: Just slightly. Maybe this means there is some tendency to stabilize.

DE: Yes, that's very good. I know for many years, you had to keep buying a new digital camera every two years, because the technology advanced so rapidly that your camera became obsolete that quickly. But now it's been more stable, more like in the film days, when a camera would last four or five years.

William Brawley/Imaging Resource: We're seeing it with firmware updates, too, that the length of time that a body can stay around can increase because you can add more software and new performance features, and things like that.

DE: ...which is something that Olympus has done a very, very good job with. We always applaud you for that, that you update firmware many times, even on older bodies. We're on version four on some cameras nowadays.

SS: Yes, yes: Yesterday, we announced the new firmware upgrade for E-M1 Mark II version 2.0. And the E-M5 Mark II and the PEN-F too.

[Ed. Note: We've been on a crusade for years now, to push companies to support their older bodies with firmware updates. As part of that, we call particular attention to companies that do so, by way of positive reinforcement. Olympus has in fact provided excellent support to owners of existing bodies, in many cases adding significant features or performance improvements long after the products were new.]

DE: So I guess the first question on our list has to do with who the users are for your advanced cameras. When we spoke with Ogawa-san last year at CP+, we heard that the main E-M1 Mark II users were people who were already Olympus shooters (Mr. Haruo Ogawa is Olympus Corporations Director, Senior Executive Managing Officer, Chief Technology Officer and Chief R&D Officer.) But you were expecting to see more SLR users beginning to switch to mirrorless. Have you begun to see more new E-M1 Mark II owners coming from other brands now?

SS: Talking about the domestic market, we found that many users have been switching to E-M1 Mark II from the other brands, beyond our expectation.

DE: Ah, that is good news for you! So in Japan, many of your E-M1 Mark II buyers are coming from other brands. What is that like in Europe or America?

SS: We're still working on the data for outside of Japan, to find out the differences between the facts and our predictions we had.

DE: It's still under investigation, waiting for sales data.

SS: We are trying to approach non-Olympus users to steer them to buy our products. Of course, from the marketing activity viewpoint, we are try to catch up users from the DSLR or from the other manufacturers. We are focusing on those kinds of marketing activities.

DE: For marketing, you're focusing on those people who you can attract. Yes. There has been a lot of activity with very compact, full-frame mirrorless, primarily from Sony, but Nikon has said publicly that if or when they do mirrorless, that it will also be full-frame. Do you see the wide range of compact full-frame mirrorless cameras impacting sales of Micro Four Thirds? And has the rapid development of the full-frame mirrorless systems affected your strategy any?

SS: The key features of our products are that they are compact, lightweight and have good ability. For a full frame mirrorless camera, even if they have a smaller body, its overall size will be increased when putting on the lenses. For that reason, we can say that our product is smaller as an overall system, among the mirrorless products in the market.

DE: So the full-frame bodies are very compact, but the lenses…

WB: You can't get past the physics of still having a full-frame sized lens.

DE: Yeah, yes. It was interesting to us - in the US, the E-PL9 was just recently announced and we noticed that all of the PR materials we saw featured women as the users. I'm wondering, do you have any kind of breakdown of buyers by gender for your different model lines? And does that male/female ratio vary between regions? Is it different in this part of world vs. the U.S.?

SS: Initially, the women's market was one of the choices that we considered. They have not yet become a buyer of our cameras, so we have considered to go in to that market on the way to achieve our strategy to expand the camera's market. We had invested in the market in Japan first and tried to get our customers, adding a feminine taste in the products to appeal to women. But we were not purposefully targeting only the women. We just tried to put the preferable style of women. On the strategy of the PENs, in the same way, embracing a good function with social networks for the PL9, we are trying to approach to those social networking users who are intending to make photos for their work, not simply for the memories, and not only for women.

DE: Ah, so you're not trying to make a "woman's camera", but some -- especially the white model -- might happen to be very appealing for women, as well as being good choices for social networking users, etc. On a similar note, do you have statistics based on sales to professionals versus amateurs? And how is that balance changing for you? (I'm not talking about the PL series with this question, just generally at the higher end.)

SS: Yes, we have. The portfolio in general is important for us. We don't want to focus on the top of the pyramid only. We'd like to see the whole pyramid growing. The PL9 product line can support the growth of the whole pyramid in our forecast.

DE: So you're feeling basically that you want to grow the whole pyramid, to grow across all your product lines. And you feel it's important as part of that to keep growing the base, as well. Many manufactures are more consciously moving away from lower-end products because there's more profit at the higher end. It sounds like that at Olympus, the focus is more on wanting to grow the bottom as well. More so than other manufacturers, possibly?

SS: We are saying that all products are important for us in our range at this moment, but we won't go below that line. Even when we say the lower end, it doesn't mean that they are cheap products. We won't bargain with cheaper prices to promote sales. Even the bottom of the line, they are kind of higher value-added products with better functioning or a high sense of style, and so on.

DE: So even your PL series, it's somewhat premium. It's entry level, but premium entry level. Not very, very cheap, just trying to… Yes.

SS: Sure. We have no intention to follow just a price driven strategy.

DE: We are curious, how has the long-term response been to the PEN-F? Has it met expectations? It's somewhat oriented towards enthusiasts, but are enthusiasts more likely to pick an OM-D model? We're curious how that plays out. The PEN-F was announced back in 2016, so it's been a while. What do you think the future holds for that kind of product, for you?

SS: They are such important products for us, the recent line-up of the PEN, PL series and PEN-F. We are in line of the initial project plan. Capability is important, you know, but we think that how the product feels is also valuable. In that situation, we think that people can distinguish OM-D and PEN, and they won't compete with each other, even though there may be a small likeness in some parts of them.

From the user's point of view, there is no cannibalization, because the PEN-F itself is really unique, I think. Once they notice the product, I think no need to consider the OM-D. Totally different. We can separate the target users.

DE: Different users, different use cases. Yeah. There are some people that will gravitate towards the rangefinder style, a kind of classic design, as opposed to an OM-D.

SS: Yes. And the selling situation has almost meet our expectation.

DE: It is almost met. So that then is a part of the line that will continue in the future. I don't know what it will be called, but there will be other cameras like that. That's good to know; especially some people inside IR like the PEN-F very much. I think that's one of Dave Pardue's favorites. It's hard for us to tell sometimes, because we will like a particular camera - you know, it appeals to one or the other of us, but we never know, whether we represent its market, or if we're just some isolated, odd guys off in the lab or something. But yeah, the PEN F a very appealing camera.

SS: Thank you.

DE: Shifting gears a little, I guess was it the last year or so you launched Olympus Pro Advantage in the U.S. and Pro Service in Europe. What has the response been like among pro photographers, and have you seen an impact from that in the form of more professionals switching to the Olympus system now that they have that service?

SS: We just launched it, so we are still trying [to find the best way to meet market demands]. Even though, we can say that it's going well in line with our strategy we planned. So far, the numbers are at the expected level, yes.

DE: The expected level of people are taking advantage. And you have seen that has been helping with professionals moving to the system?

SS: Yes.

DE: And when you are trying to convert professionals from other systems to switch to Olympus, what have you found are the most important factors? Is it about the cameras themselves? Is it the selection of lenses, or something else?

WB: Like pro support…

DE: Like pro support, yeah. What is it that works for you, or how do you pitch it to people to get them to make that switch and what do they respond to?

SS: I would say that there is a particular scene that could only be taken by an Olympus camera. There are many occasions that a compact, mobile type of camera, like Olympus ... only that kind of camera can make the shot. You may get a scene unexpectedly popping up in front of you, or you may be in a location where you can't use a tripod, and so on. Our cameras can make a shot even in such a challenging moment. This is our advantage, and we will continue to [pursue] the development of our camera on its functionality.

DE: Ah, it's their mobility and also your excellent IS. You don't need a tripod, so it's very mobile that way also.

SS: Yes, that's right. So the small size, the system mobility, is really a benefit for photography in the field.

DE: That's really the big argument for getting someone to switch, then, to say "Look, you don't have to carry 20 pounds of gear."

SS: Yes, and so the fields in which we can offer this advantage, like wildlife photography, or that kind of field, we like to focus on the benefits we can give to the photographer.

DE: So you look for markets where that mobility is very important, and then you have a competitive advantage that you can market, yes.

SS: Also the ruggedness of our system is unique and we're proud of that. You're already aware from your shower test... <laughter>

DE: Water resistance, yeah, yeah.

<laughter>

SS: That kind of performance or character.

DE: That ruggedness is part of the mobility, also.

SS: Yes.

DE: The people who value the mobility are also people that care about weather resistance; yes, I understand. So system mobility is very important, but once someone's in the Micro Four Thirds system, do you have a sense of what the users value the most? Is it the weather-sealing, autofocus speed, image quality? And are your engineers and designers working more to further enhance current strengths, or is it more that there's some unmet need and so you put resources there to try to strengthen that area? Do you further increase the strengths, or do you try to find the areas where you're less strong?

SS: We set about doing both of them. We are trying to expand in our strong area and also for our weakness, we are trying to catch up by improving and development.

DE: <laughs> Yeah, I guess you can't only do one.

SS: Other companies cannot follow us in the area where we have an advantage. It's a basic idea but, we think that we can catch up with others by innovation with the technology.

DE: So the engineers, you will see a weaker area and then you will feel that you can bring new technology to bear on that.

SS: Since we introduced the E-M1 Mark II, we are able to get all the feedback from professional photographers. These uses are really tough. And they have very special requests or demands. That kind of professional voice really affects our advanced technology…

DE: Ah - so as you have had a products that are attracting more professionals, now you are getting more feedback from professionals, and that is driving your technology more.

SS: Yes.

DE: I see. So the system mobility is very important. But it's also very hard for someone who is heavily invested in some other system to all of a sudden decide "I'm going to switch." Are there any particular strategies you have, or is there anything you can do to make that easier? You don't have a trade-in program, obviously. I guess it's probably comes down to system mobility again, but I wonder how do you make someone finally cross that bridge?

SS: Some may switch to us, but there will be some who are going to add to their system to make a shot that was impossible to realize with their existing system. Those users will be significant, we think.

DE: Ah, yes. So it's not an either/or choice, it can be a case of wanting to have a very compact body for some situations, maybe a couple of lenses for a specific use case.

SS: Yeah, it depends on the situation. They can use the best system.

DE: Yes.

SS: Fortunately, our system is not so expensive.

<laughter>

DE: Yeah, that's a good point. You can start with a very capable body and some very, very good lenses and you don't have to spend ten thousand dollars to do it, so, yes; interesting. Speaking of lenses, we're very interested in your f/1.2 lenses. We have heard in briefings that the process for producing those to the standards that you've established for them is very rigorous, and it's taken a lot of investment in manufacturing and engineering. One of our editors wonders, as Olympus has stabilized financially, has that allowed you to pursue difficult or high-investment development? And was it was a matter of waiting for the right time as the company became stronger, that it's like "Ah, now we can afford to make those kinds of investments?"

SS: Innovation is required for the business to maintain its position and continue to grow. Without investment innovation is impossible. So to the extent that we plan to continue our business, we have to invest in it. This is the basic DNA of Olympus. In addition, the technology developed in the imaging sector covers all of the needs of Olympus as a driver, in all areas. The investment of technology is established in the imaging sector first, in order to roll it out in the other units. That kind of the investment is not only for the imaging business, but for Olympus as a whole. Now we have very good cooperation between each business unit. The medical unit is taking care of the R&D resources for almost the entire business.

DE: Ah, so there's been a restructuring; the R&D now is shared more.

SS: The [fruits of] the technology are utilized in the imaging sector first, then it's taken in the medical sector to use, because the life cycle of the medical applications are longer than the imaging ones. So initially we start our investment in the imaging sector, then hand it over to the medical sector.

DE: That's very interesting, I hadn't thought about that. I had thought that medical is so big, that their resources would drive the whole program. But really, they have longer life cycles, as you said. And so it's the imaging part of the business that drives the medical. But having the medical business there helps you justify or underwrite some of the core R&D. Very interesting!

SS: Yes, absolutely. Technology investment is not only for the imaging business, that's the point.

DE: Yes. I would think some things are so different though, between medical and imaging. Endoscopes use very tiny optics, whereas in the photography world, we have large aspherics and things like that. And you say that the imaging drives that. Do you mean imaging just in terms of the sensor and processor and imaging processing, or is it also in terms of optical technology? And if it is optical, how does that translate from a big f/2.8 camera lens to a little endoscope?

SS: It's not only the device technology that the medical sector uses that's taken from the imaging sector. For instance, the manufacturing skill is also important, so the skills that we've cultivated in the imaging sector can be expanded in the medical sector, too. Recently the medical world is becoming a disposable business, which involves a kind of mass production that [hasn't been seen before]. That requires a knowledge of consumer business and experiences in that area. In many ways, we can say that they are connected verry closely.

DE: Ah, very interesting! So the individual optical elements might be very different, like the very large aspherics in your f/1.2 photographic lenses. But the processes that you’ve perfected in making these kinds of lenses, with very precise alignment requirements, can translate into more efficient manufacturing for the medical side of your business. With the f/1.2, I know you told us that there was technology that came from the microscope division for characterizing lenses. I’m curious to know more about what that is about, and what that technology was, as it seems that that’s a case though where something from scientific R&D helped with the camera and imaging.

SS: Yes. That's right, this is one example.

[I realized after the interview, that we actually had heard previously that the Scientific division's contribution to the f/1.2 lens was through technology to very precisely characterize lens aberrations, in greater depth than had previously been possible. You can read about it in our story "The new bokeh champs? Olympus cracks the code for beautiful bokeh with its F1.2 Pro prime lens series." - I can say that that was the first time I really understood what contributes to good and bad bokeh :-)]

[Ed. note: There was quite a bit of back and forth discussion here that would be confusing for us to just transcribe directly. The very condensed bottom line is that research and development in one area (medical, scientific or imaging) can help drive advances in the others. This creates leverage in Olympus' R&D spending that other companies may not have. In the example mentioned above, budget and effort invested in R&D for endoscope manufacturing resulted in expertise that helped the Imaging division manufacture their f/1.2 lens series. As noted immediately above, aberration-characterization technology from the Scientific division also contributed to those lenses. While some R&D may be very specific to a given division, in many cases, an investment in one business area brings benefits to the others as well. This lets Olympus get more bang for their R&D buck than would be the case if the three divisions were separate companies - it's basically a multiplier effect on their R&D investment, because each division receives benefits from (some of) the R&D conducted by the others.]

DE: So, our very last question, then. Strategically, over the next two or three years, what do you think is Olympus' biggest challenge? (I'm talking about the imaging market, specifically.) What is your general strategy for addressing it?

SS: For the technology, we have a roadmap. We need to follow the roadmap for products as well. Then we go ahead following them. The technology is fine at the moment. On the other hand, because of the very painful last few years [Ed. Note: Olympus was rocked by an accounting scandal in 2011, that finally seems to be well behind them], we shrank the function of the sales and marketing a little bit, right? But because of that, our business situation has become healthy. Since as I said we already have a roadmap, we can now start to focus on communication, marketing and sales again.

DE: Interesting. So it wasn't an option for you to stop the innovation or the development. Even though budget was tight, times were difficult, you had to keep pursuing the roadmap. But now that you are becoming stronger, you can actually market that more. That's basically the case?

SS: As I said, innovation is important for our business. We never stop that kind of mindset and action.

DE: Yeah, that's very interesting. And so the question earlier we had about the, you know, having the resources to invest in developing f/1.2 lenses and things like that, it wasn't a matter of whether you have resources to do that. You have to do it, and then if it means you have to starve marketing for a while, you do that instead.

SS: Yes.

DE: Ah, very interesting. I think that's all of our questions for now, thank you very much!

WB: Thank you as well.